ENERGY DRINKS MARKET

In 2021, the energy market was estimated to be worth USD 86.35 billion. During the forecast period of 2022–2027, the energy drinks market is expected to grow at a 9.12% CAGR.

Fitness clubs and other sporting stadiums were shut down in major sections of the world after the COVID-19 pandemic began. On the other hand, consumers continue to workout and engage in various exercise regimens in their homes, resulting in a steady demand for energy drinks. Immunity-boosting foods and beverages that are high in vitamins, minerals, and other important components to promote immunity are becoming more popular. As a result, there are more companies in the market for functional energy drinks. Brands are attempting to capitalise on the "immunity-boosting" craze by integrating purported components or putting the concept of immunity boosters into their marketing efforts.

The demand for non-carbonated drinks has grown as a result of greater urbanisation, higher disposable incomes, and rising health consciousness among consumers. Adolescents use energy drinks since they believe that they improve their performance, endurance, and alertness. Long and unpredictable working hours, as well as an increase in the number of social occasions, are leading customers to use energy drinks.

Furthermore, rising incidence of lifestyle-related diseases, as well as an increase in the number of health-conscious customers and increased consumer awareness of active lives, have pushed health-conscious consumers to choose for sugar-free and healthful beverages. As a result of an increase in advertising techniques, the energy drink industry is also expected to grow.

Key Market Trends

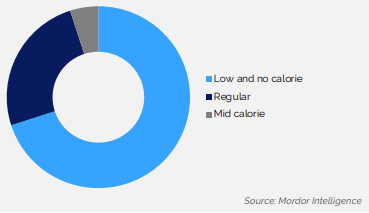

Consumer Preference for Low-Sugar/Sugar-Free Beverages is Growing As a result of the increased prevalence of diabetes, consumers are becoming more aware of the importance of a well-balanced diet and an active lifestyle. As a result of rising health concerns and greater efforts to prevent the emergence of lifestyle illnesses, consumers are choosing low-calorie, low-sugar, or sugar-free dietary patterns in foods and beverages. Consumers prefer natural sweeteners in their beverages, such as stevia. PepsiCo Inc. and Coca-Cola have vowed to eliminate artificial ingredients and reduce sugar content in their drinks. Additionally, changing consumer preferences for sugar-free or low-sugar beverages spurred beverage manufacturers to develop new products. Customers are avoiding sugary drinks to prevent the harmful consequences of excessive sugar consumption, so these companies are working on a variety of new products to meet the increased demand for such items.

Energy drink companies, such as Red Bull, adopted a similar strategy, diversifying their product offerings to fulfil the needs of health-conscious consumers. For example, Red Bull's Red Bull Zero was released in 2020.

Energy Drinks Market

Market Share (%) of Carbonated Soft Drinks, by Variant Type, United Kingdom, 2020

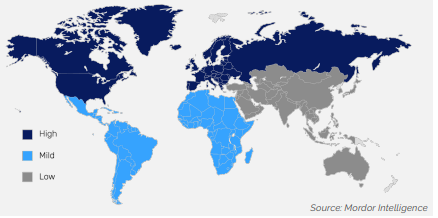

The market is dominated by North America The huge usage of energy drinks in the United States, along with the country's massive coffee culture, has propelled the concept of energy shots into the mainstream, which is a major driver boosting energy drink sales in the country. In the United States, energy drinks are a staple of social events, parties, and celebrations. Manufacturers like Red Bull and Monster Beverages provide their energy drinks in a variety of flavors and two major packaging options: PET bottles and cans, giving consumers a wide range of options to pick from. Furthermore, soda consumption in the United States is dropping, which has created a wonderful opportunity for companies like Coca-Cola and PepsiCo, which are attempting to capitalize on the brand familiarity of their legacy brands by expanding into the booming energy drink market.

Competitive Landscape

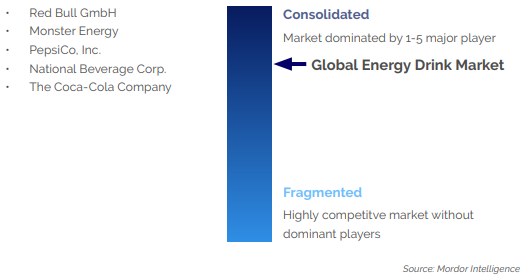

Energy drinks are a competitive market, making it difficult for new and small businesses to succeed. Monster Beverage Corporation, Red Bull, The Coca-Cola Company, Rockstar Inc., and PepsiCo are just a handful of the many energy drink brands with significant market shares. To increase their energy drink production, companies in the industry are focused on personalization and convenience, as well as providing healthy, zero-calorie, and lowsugar functional energy beverages. Additionally, product launches may assist organizations in capitalizing on the enormous growth potential in developing nations. Advertising and celebrity endorsement are used by most manufacturers to raise product awareness. Energy drink companies, for example, fund sporting events.

Major Players & Market Concentration

Last updated